A Recipe for Forclosure….Short Sales and Private Mortgage Insurance….

Are you a real estate agent working on short sale approval for your seller? Under the best of circumstances it can be a challenge. But there could be the delays could be contributed to private mortgage insurance companies (PMI).

Private Mortgage Insurance companies provide mortgage insurance to protect lenders from losses due to default on mortgages. It is for conventional loans only. Fannie Mae and Freddie Mac purchase loans at an 80% loan to value (LTV). Anything more than an 80% LTV require mortgage insurance for the loan to be eligible for purchase.

Guidelines changed in 2005 establishing 100% financing either with 80/20 loans, allegedly to eliminate the mortgage insurance; or 100% LTV’s with PMI, allowing credit scores as low as 580.

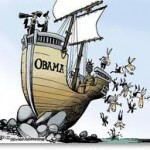

Banks decided they were not comfortable with the risk on a few of these loans. So they asked their good buddies, the PMI companies, to help them out. They gladly slapped policies on the these loans, because their BFF’s (the banks) were, well, their BFF’s. What could possibly go wrong? Oh yeah, the mortgage meltdown.

And does anyone else think that not informing the borrower, stinks?

It is all about protecting the bank’s interests, not the clients.

Fast forward to today and agents working short sales with private mortgage insurance, now have another entity involved. The seller may not even know they have PMI and the listing agent may not be made aware of the PMI involvement. Banks are not in any hurry to get a short sale approved because they are guaranteed a monetary bonus from the PMI company if the seller defaults.

Also, if a PMI company is involved, they may want a portion of what they are going to pay the bank supplemented by the seller in the form of a promissory note. Arizona implemented a non-deficiency law in the 1930’s therefore sellers end up in foreclosure for the simple reason it will erase any amounts due to banks or private mortgage insurance companies.

FYI: Today’s private mortgage insurance companies will insure loans up to 97% LTV’s, in Arizona 95% LTV.The minimum credit score is 720 and ratios of debt-to-income are between 41% to 45%, depending on the program. (Non-negotiable, because the very nice person key was removed from the loan applications in 2008.) The credit score and loan to value, determine the level of risk or rate the mortgage insurance company will charge.

And those 580 credit scores in 2005-2006? Some families were paying over $300.00 a month in private mortgage insurance.