First, who or what sets the mortgage rates?

• The 10 year U.S. Treasury notes or bonds. They are sold to pay for the U.S. debt.

• 10 year treasuries are considered one of the world’s ultra-safe investments.

• Demand for the bonds is higher in times of financial turmoil, global unrest and icky economic news.

How Does It Work?

• The bonds are sold at auction by the Treasury Department. If there is a lot of demand, Mortgage Rates go down.

• If there is not a lot of demand, for instance, the economic news is rosy, Mortgage Rates go up.

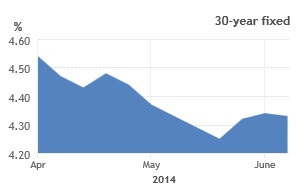

• Bond yield prices change every day, therefore the fluctuation in interest rates.

Global unrest in Iraq and Russia, along with the surprising Ping-Pong of economic news, affects our interest rates. For instance, Durable Goods Orders, stuff that is not consumed or quickly disposed of, like refrigerators and cars (unless you’re my 17 year old son), fell in May. The Gross Domestic Product, GDP, or the monetary value of all goods produced in America, like wine, reported a whopping loss the first quarter of 2014, the largest loss since 2009.

Yet, on the other side of the net, the housing market is stabilizing with housing prices still improving and more families buying homes. Also, fewer people are unemployed. Rates should stay low until the entire economy becomes stable.

There is no crystal ball in which to predict when that will be a reality. So, if you drink, drink more wine, boxed or in a bottle, or beer, as long as it is made in the U.S.