TheMortgageAdvantage.com

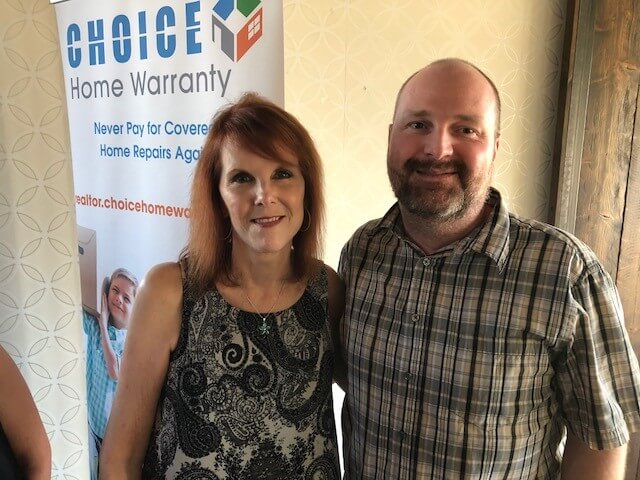

- Shelley and Charles

Road To Home Ownership

Preapproval for your new home in 15 minutes or less

Contact Us

The Mortgage Advantage, PLLC

9180 S Kyrene Rd., Ste 101

Tempe, AZ 85284

There are a few states in which homes are still affordable. For instance, West Virginia, Alabama, Mississippi, Iowa, North Dakota’s housing prices have shown minimal increase but do require either snow blowers or buckets of mosquito repellent. Arizona will continue to entice those longing for a combination of economic progress and good climate with no natural disasters (so far). Our housing market is expected to expand again this year, but not the eye-popping increase we saw in 2021.

Interest rates are going to suck. (My apologies for the inappropriate language, I wish I could blame it on my granny.) Treasury yields, which determine our mortgage rates, are pushing higher at the fastest New Year pace seen in 20 years. That means higher mortgage rates, like, now. It could mean rates in the… (pardon me, while I use the F-word) four percent range.

Self-employed borrowers will suffer through another year of COVID overlays implemented in 2020 by the government, which were set to expire this month. Along with their tax returns, profit and loss statements, borrowers will continue to provide two months of up-to-date corporate bank statements to prove their business is viable. (Really, a comfort letter from a CPA, an internet site and an anal probe is not enough?)

The 2022 second home mortgage change is going to hurt. Second home purchases and refinances will have a substantial increase in mortgage rates, slapped on by Fannie Mae and Freddie Mac. (Borrowers swear they are buying a second home until they decide to VRBO after closing.) We probably won’t experience the increase until February or March. Just an FYI, occupancy fraud is the LEADING cause of mortgage fraud in the U. S. and is a class-four felony. So ask yourself, do you feel lucky? Or look fabulous in striped prison garb?

Many of us, especially those who have been sick or who cannot find a date, are welcoming 2022 with open arms.

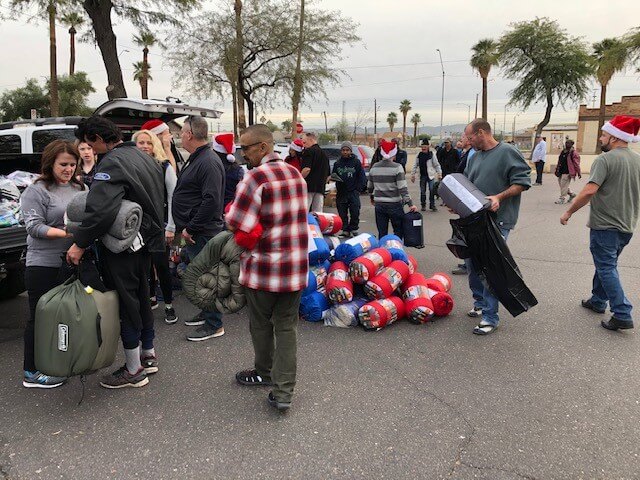

We appreciate our family, friends, wonderful staff, semi-adorable children, and awesome clients for getting us through 2021. Here’s to a healthy and profitable 2022, we all deserve it!

As Always, we offer:

• CONVENTIONAL LOANS

• FHA

• VA

• REFINANCE and CASH OUT REFI

• JUMBO

• HOME IMPROVEMENT LOANS

• NON QM

• FOREIGN NATIONALS

• BANK STATEMENT PROGRAM

Like YOU we are always working. Call us anytime!

Diane Gerdes

480-235-5667

April Chadwick

602-740-5319

About Us

The Mortgage Advantage is honored to assist families and individuals achieve their homeownership dreams. We offer flexible rates, low fees and can close quickly.

Our loan officers are educated in today’s ever-changing mortgage environment. We inform borrowers of their loan options, whether it’s for a home today or next year.

As a service, we offer prequalifications at no cost along with guidance on loan criteria. We also can help improve credit and credit scores.

The Mortgage Advantage firmly believes that personalized and professional service creates lifelong relationships. We are grateful for our past and current clients.

We are your advocate in mortgage industry. Our borrowers work directly with us. We welcome the opportunity to work closely with you through-out the entire loan process.

MISSION STATEMENT

Our mission is to be personally committed to our Clients, all Real Estate Professionals, and our Employees.

TheMortgageAdvantage.com PLLC was founded upon the essential principles of teamwork, consistency, and technological innovation.

We pledge to treat each transaction with an urgency of purpose and dedicated spirit, further fueling our vision of the way lending can, and more importantly, should be done.

TheMortgageAdvantage.com PLLC is grateful of our clients, real estate agents, vendors, and our employees who have worked with us through the years.

Truth in Lending Promotes Trust in Lending